|

HST officially kicked in for Ontario on July 1, 2010.

There's actually not a whole lot for you to do within

BusinessVision to implement HST. There are two main areas to pay

attention to: selling (Customers and Order Entry), and buying

(Accounts Payable and Purchase Orders).

There will be no BusinessVision program update for HST.

Additionally, pretty well any version of BusinessVision will

handle HST. There is no need to upgrade to the latest version

specifically to handle HST.

There are quite a few transition rules to keep in mind as well.

For details on these, please consult your accountant or CRA.

Please feel free to contact Wildwood Canada for more

information or assistance with your HST changeover.

Topics on this page

Set up a new Sales

Tax Code for HST

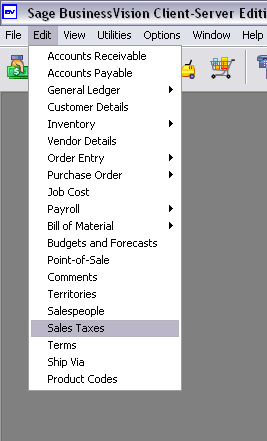

First you must set up a new Sales Tax Code for HST.

1. This is done in Edit, Sales Taxes

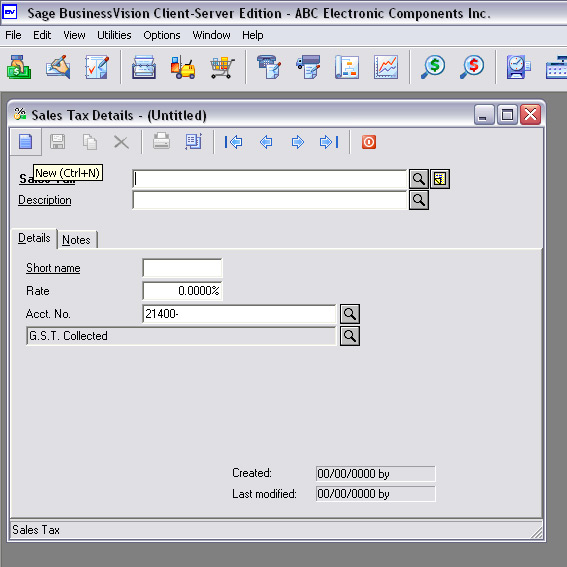

2. Click on the "New" icon.

3. Enter an ID for the new tax. This will be a 4-ddigit number.

Make it the next number after the current highest number you are

using, or some other number if you wish.

In this example, I will use "0003".

PLEASE NOTE that your Sales Tax Codes may be different.

**ALSO NOTE that a separate HST Sales Tax Code is required for each

province, as they have different rates.

By the way, this is a good opportunity to clean up your Sales Tax

Codes if needed.

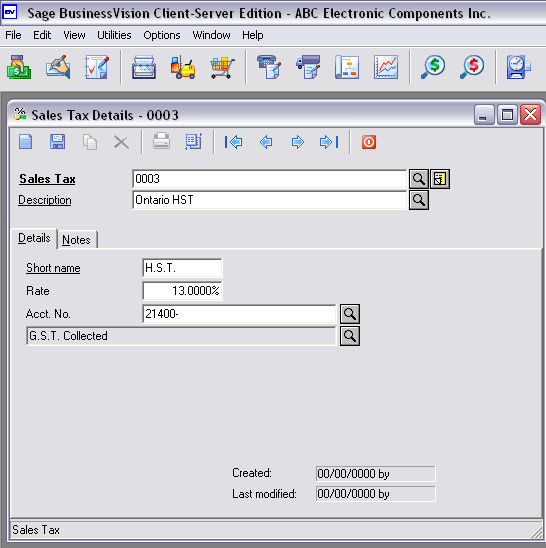

Fill out the fields as shown in this sample. Most people will

post HST to the same GL Account as GST Collected, as these two taxes

will be remitted together.

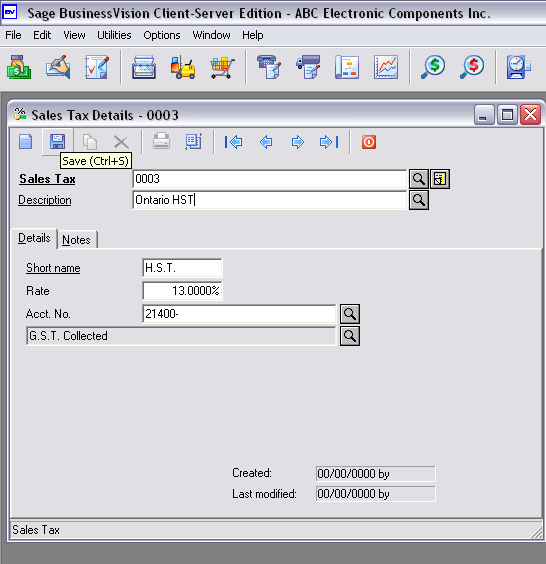

4. Click the "Save" icon to save the new Sales Tax code.

Accounts Payable &

Purchase Order - system-wide setting

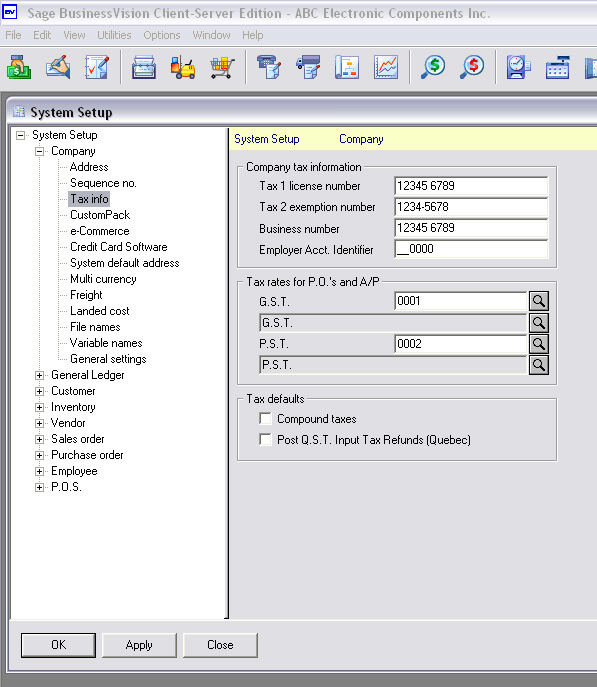

In BusinessVision the sales taxes for Purchasing and A/P are

controlled by a system-wide setting for each BV Company. There are

two Sales Tax Codes that are set in System Setup which govern what

taxes are used for all A/P entries and PO's.

To change these two Sales Tax Codes...

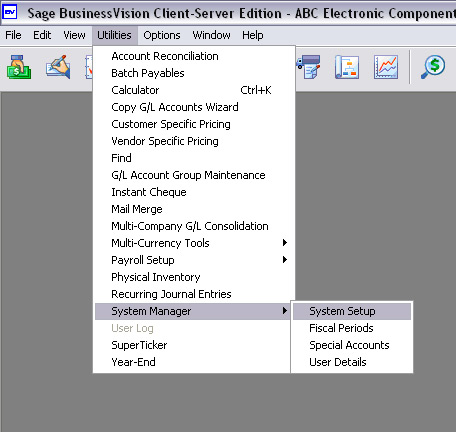

1. Go to System Manager, System Setup. Everyone else must be out

of BusinessVision.

2. Go to Company, Tax info

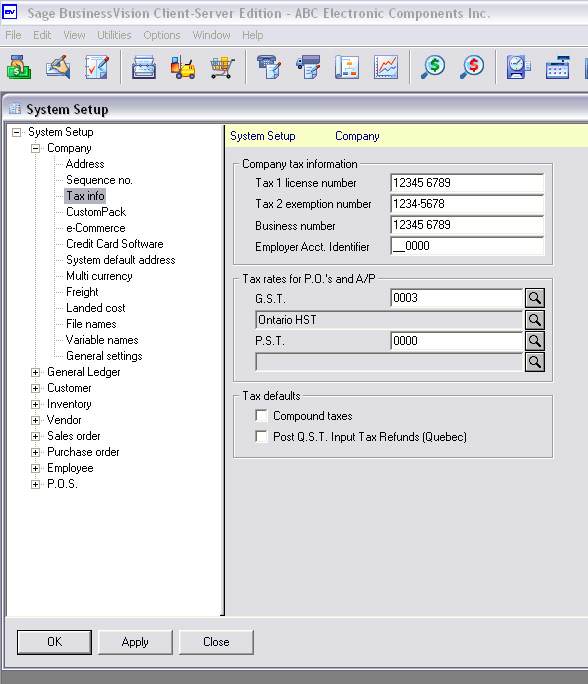

3. In the section, "Tax rates for P.O.'s and A/P" enter the new Tax Codes

as appropriate. In my example, it will be Tax Code 0003 for

the "G.S.T.", and Tax Code 0000 for "P.S.T.".

Notice that the titles for each Tax Code won't change! But the

actual codes show the description of the selected Sales Tax Code.

4. Click "Ok" to save your changes.

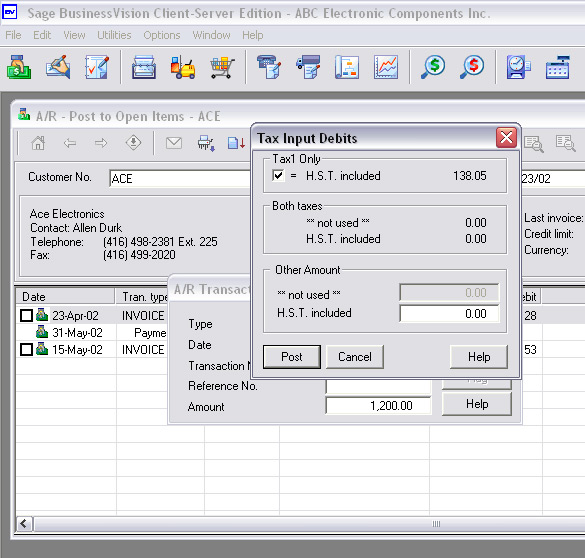

Accounts Payable -

invoice entry

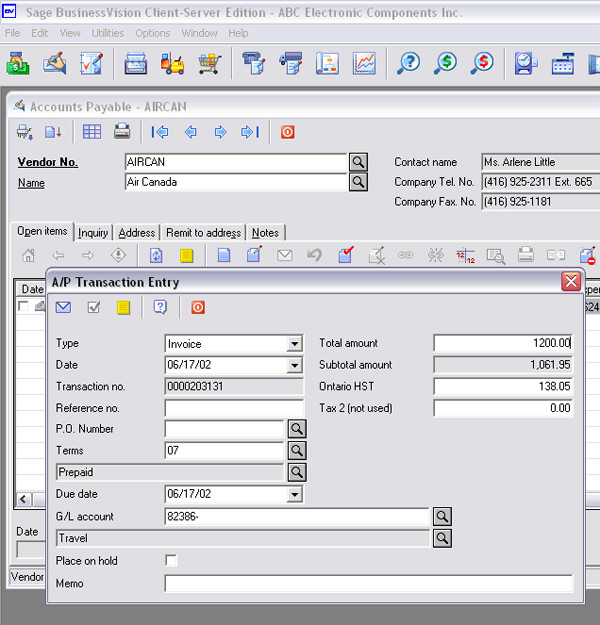

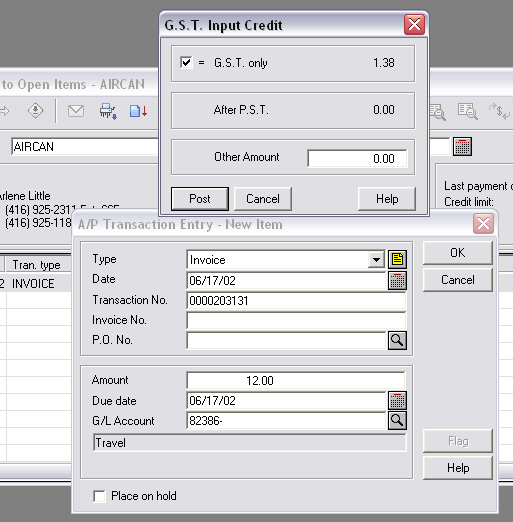

BusinessVision v7.3 (v2009) and later: When you enter a

new invoice in Accounts Payable, you will notice that the Sales Tax

labels have changed to reflect your changes in System Setup. You can

override the Sales Tax amount, but not the Sales Tax Code.

BusinessVision v7.2 and earlier: When you enter a new

invoice in Accounts Payable, you will notice that the Sales Tax

labels have not changed! However, the Sales Tax Codes you set up in

System Setup will be used.

You can enter a different amount in the "Other Amount" box as usual.

Purchase Orders

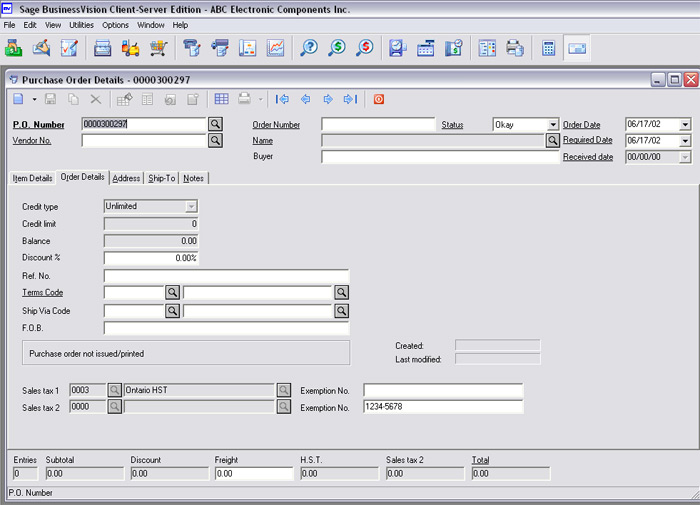

When you enter Purchase Orders, the Sales Taxes are shown under

the "Order Details" tab. These are the codes that you set up in

System Setup.

Unfortunately, you can't change the Sales Tax Codes, you can only

exempt one or both by typing something into the "Exemption No."

field.

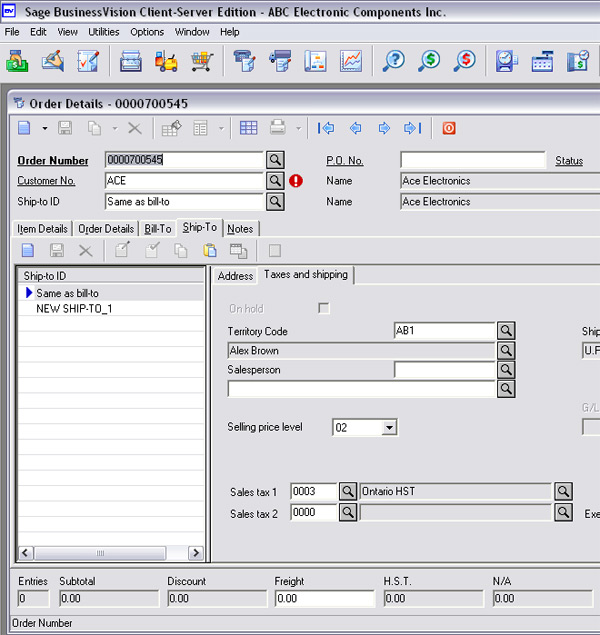

Customers

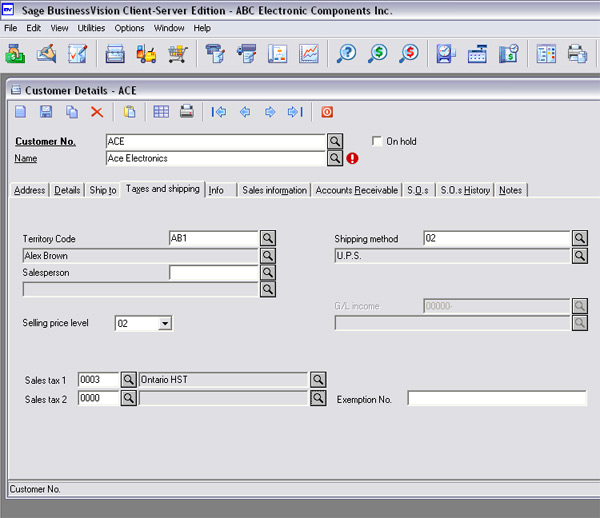

Sales Tax codes are set in the "Taxes and Shipping" tab for each

Customer. For "Sales tax 1" select the new HST Tax Code you created.

Set "Sales tax 2" to 0000. Save your changes.

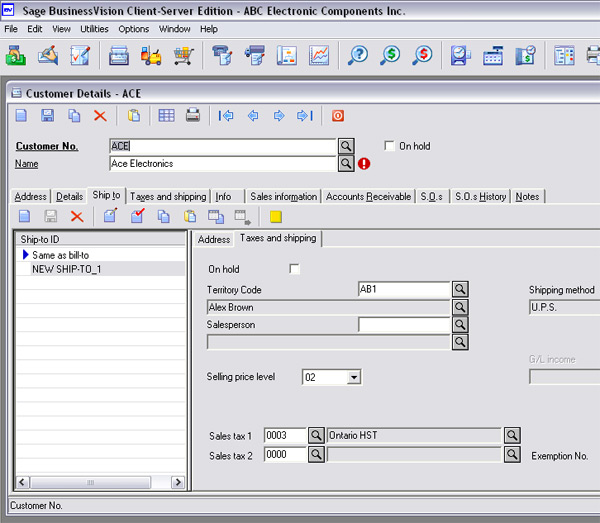

Don't forget that Sales Taxes reside with the Ship-To codes as

well. If you use Ship-To codes, these must be changed as well.

| Sage BusinessVision has released a

convenient utility program that can change all your

Customers' Tax Codes at once.

For your convenience, you may download

this utility from the Wildwood Canada website

HERE.

You will require a username and password to do so. This

would've been emailed to you in one of my recent

newsletters.

To install and run this utility you

will need to understand how to save files from the

Internet, unzip the file, install the program, and then

run it.

If you require assistance, please

contact Wildwood Canada for assistance with this

(Wildwood Canada clients only)

|

Order Entry

In Order Entry, the Sales Taxes default to those for the selected

Customer and Ship-To. The Sales Taxes are under the "Taxes and

Shipping" tab under the "Ship-To" tab. The Sales Taxes can be

changed for each Sales Order.

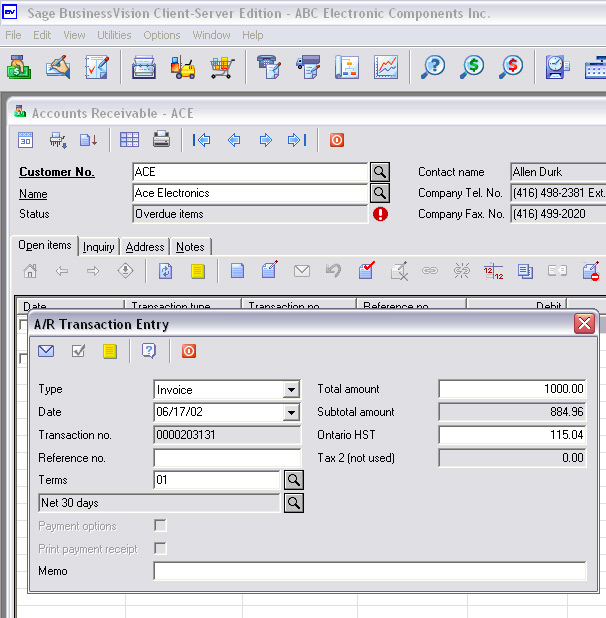

Accounts Receivable -

invoice entry

BusinessVision v7.3: When you enter a new invoice in

Accounts Receivable, you will notice that the Sales Tax labels have

changed to those set for the Customer you are working with. Only the

amount can be overridden.

BusinessVision v7.2: When you enter a new invoice in

Accounts Receivable, you will notice that the Sales Tax labels have

changed to those set for the Customer you are working with. Only the

amount can be overridden.

Special HST rules, considerations

and exceptions

- Transition Rules: There are special transition rules

in effect that determine whether GST-PST or HST Sales Taxes must be

charged on a particular sale during the periods preceding and

after July 1st 2010.

- ITC Recapture: If your sales are more than $10

million per year you may be subject to something called "ITC

Recapture", which means you cannot claim 100% of the HST charged

on your purchases for certain expenditures.

For more information on these and other HST issues, please see

your accountant and/or attend one of the many free seminars being

put on by CRA, accounting firms, and others.

Forms: Invoices, PO's,

Quotes, etc.

In most cases no changes will need to be made to any of your

forms that you print, such as invoices, PO's, Quotes, etc. This is

because the Sales Tax names are set to automatically print correctly

on the form for whatever Sales Taxes you are using. That is, unless

some unusual modification has been made to your forms to override

this.

BUT... your GST (soon-to-be "HST") number will still print at the

bottom of your forms as a "GST Number". This is not critical,

however will need to be changed at some point. To change this the

actual form template needs to be changed. I suggest I change this

for you the next time I visit you, or the next time you upgrade your

BusinessVision.

If you are using pre-printed forms they will need to be

changed. If you have a large stock of pre-printed forms, the BV form

template can be modified to black out the existing descriptions and

print the new one for HST. Please contact Wildwood Canada to have

this done. |